- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3691

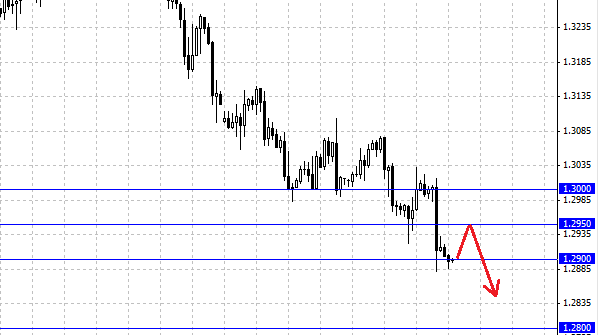

Trading on the foreign exchange market on Thursday held a press conference in anticipation of the ECB and the speech of the head of the bank Draghi. During the conference, Draghi said the ECB will keep rate soft policy and will do it as long as necessary. The European currency has reacted to this statement a strong reduction, increased pressure on the euro and the fact that Moody's has downgraded the ratings of three troubled Spanish banks. All of this eventually led down a pair of EUR/USD to 1.2880 level, reinforcing the downward movement. Support is at 1.2900 area did not allow the pair to consolidate below, the pair EUR/USD rebounded from the lows to the level of 1.2930, and then again began to decline. European currency is now in limbo, Draghi comments left a negative mark on the market, but at the same time reducing the currency is constrained by the level of 1.2900 . We believe that the EUR/USD pair will be some time to trade above 1.2900, next target is to roll back the level of 1.2950 . Since It's Friday, and this week the European currency fell well enough it's likely that many of the medium-term traders will take profits, this will surely have support for the euro and then we can expect a strong recovery up to 1.3000 . However, the basic mood of the pair EUR/USD negative and immediate goal in the medium term is the level of 1.2800, the territory of which the market has already came.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3568

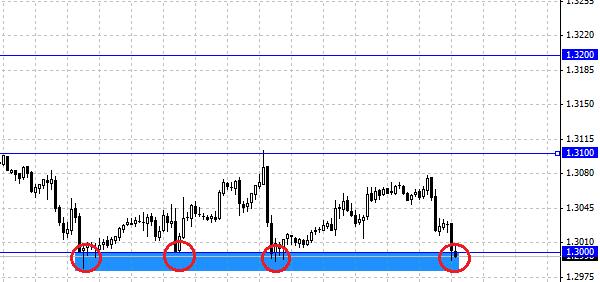

The European currency is adjusted back to a level of 1.30 after the recent breakdown, downward pressure is constrained by market expectations of the ECB. ECB meeting should shed light on the future prospects of the euro, although we do not expect the ECB comments can change the overall downward trend in the euro, they can still provide temporary support to the European currency. It should be noted that Morgan Stanley analysts maintain a short position on the euro, while the EUR/USD pair dropped sharply after rising tensions in peripheral Europe. "Sustainable fall below 1.30 dollar now opens the way for the decline in the direction of our target level of 1.2800 dollars" - note in the bank. The weakness of the euro, and also indicates that the attempt to gain a foothold above the 1.30 level, though hosted on the closure of the day, but the movement stopped in this area. If after report ECB pair EUR/USD will overcome the level of 1.31, then we can talk in the possibility of reaching the level of 1.32, at which we believe will begin selling the new active.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3419

Before the opening of U.S. markets, it is possible to observe the strengthening of the U.S. dollar against other currencies. Since EUR/USD pair dropped to support at 1.30, this support does not always display their strength, and at the moment it will be a 4 dollar attempt to break it. Do not forget that the market moves in waves, a sharp increase in the dollar has pushed hard enough a couple of down, so we believe that before the euro starts to fall again, rollback should occur. The basis for this rollback just might serve as a level 1.30. Treyderam should closely monitor the movement of the pair near this level and the need to act - to open short positions if the euro will fall below the support level of 1.30 or buy the currency at current levels to 1.31 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3611

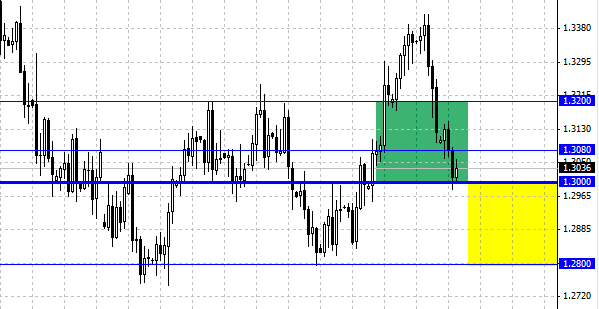

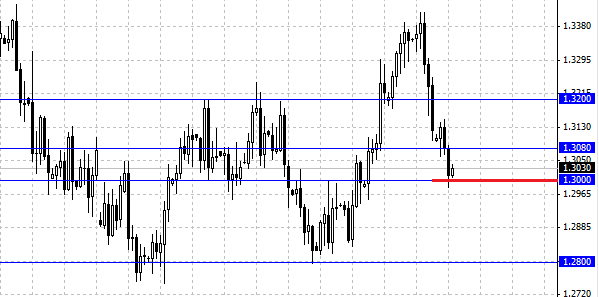

During the trade on Thursday investors’ attention was directed at American data which turned out to be better than predictions. It provided some support to dollar and EUR/USD pair again dropped to the level of 1.30, where it can now be observed a strong support is. European currency retreated from minimal value after checking the strength of level of 1.30 and began to from a new rebound. The closest aim is still the level of 1.3080. Today on Friday one should not forget about the fact that many medium-term traders and investors will begin fixing profits which can influence positively the EUR/USD pair.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3697

Currency pair EUR/USD during auctions on Wednesday was in a negative zone. European currency continued its fall even after publication of negative data on gdp from the USA, which instead of mentioned 2.4 % dropped to 1.8 %. Nevertheless, the investors decided to ignore economic data and euro sales continued throughout the day. From technical point of view EUR/USD pair reached its closest aim of 1.30, but without being able to break the support it rehabilitated from minimal value close to the end of the day. At the moment one may see technical rebound from the level of 1.30, but the growth is rather weak and most likely EUR/USD will try to consolidate lower than 1.30, thus continuing the descending trend, the growth of the pair will be restricted by the previous maximum which is at the level of 1.3080, achieving this level will be a good point of entry for sales. Today is full of statistics from the USA and Europe and this data will probably influence the market mood during the day, especially important news will be requests for unemployment benefits and unfinished deals on home sale.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3700

European currency after fall on Tuesday during the session is now in a hanged position. Currently the pair is heading towards the support at the level of 1.30. Market participants today will expect the news form the USA, to be more specific gdp data. Due to latest events we have reasons to think that the numbers that come out on gdp will be better than analysts’ prognosis, and they will support American dollar and will give strength to its growth. EUR/USD pair in this case can drop lower than 1.30 which will open its way to the level of 1.28. Otherwise the negative data on gdp of the USA can return the pair to the level of 1.32, where the significant resistance is situated.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3696

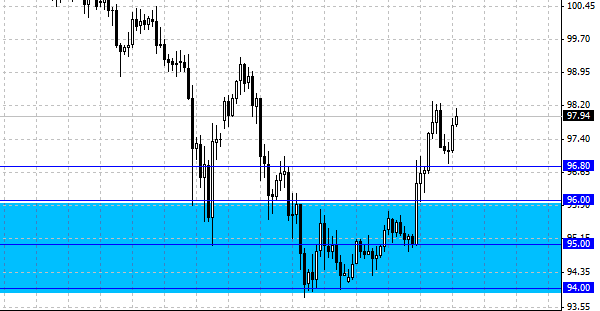

The currency pair USD/JPY continued to grow confidently during the session on Thursday, the US dollar has grown quite well against all the currencies. However, after the growth to the level of 98 the pair USD/JPY met significant resistance, and the market stepped back from maximal value. In this area the traders will meet a little resistance, because the daily candle could not close higher than the level of 98, which is a technical level of resistance. However, I do not expect this to become a resistance of big value and it will provide a good possibility to buy.

With the route that Japanese market of government bond fund has chosen it is hard to say what can happen in the near future. However, we think that long-term perspective for this pair is aimed upwards, and while rates of interest are growing in the USA, Japanese bank is starting to buy more bonds. At the same time the difference between rates of interest should continue pushing this market upwards.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3860

Bernarke supported the dollar

EUR/USD pair continued descending on Thursday during the European session. The press-conference, as well as commentaries and responses of its participants landed strong support to American currency, despite the fact that Federal Reserve System made a statement about the beginning of closing the policy of quantitative easing later this year. However, the market has been expecting it, because the chairman of Federal Reserve System made a statement about the possibility of this outcome towards the middle of next year. Decrease or stop of the policy of quantitative easing frees the market from constant supervision and security on behalf of the USA.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3909

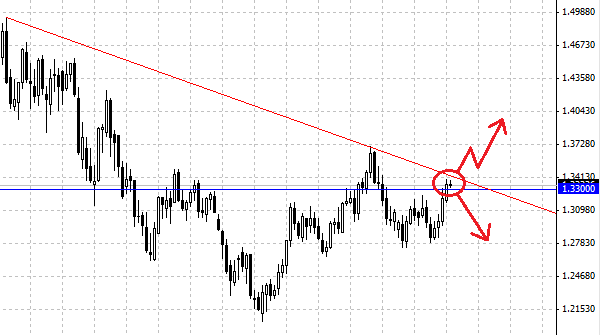

Will the descending trend on EUR/USD end?

EUR/USD pair has been falling for the most part of Monday. But it found enough support in the area of 1.33 to attract customers. The most interesting fact on graphs is that the market just formed 4 consequent hummers in succession, based on this level of support. Due to that we assume that the level of 1.33 will continue supporting euro. However if you look at the daily graph, one can bring strong arguments in support of line of fall of business activity on EUR/USD pair, which is passing the level of 1.34, and the descent of the pair confirms its existence. If the market can grow higher than that line of descent tendency, we assume that this market will become dangerous, and we will be able to see a rapid growth of euro.

We think that the catalyst to abrupt change of quotations towards a higher level will become the speech of chairman of FRS and words that he utters at the meeting later this week. If there is no word about ending the program of quantitative easing, there is a possibility that markets will consider this as "QE Forever", as they had done earlier and one can forget about US dollar. If that happens, euro will grow naturally.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3857

Euro is approaching the upper border of the descending movement

European currency dropped lower than 1.33 during the session on Wednesday, but the investors began to buy the pair EUR/USD, after which the pair suddenly grew higher than the indicate area. The level of 1.33 is now the support, and we expect growth to the level of 1.34 in the future, at the moment the pair has reached the level of 1.3390, now there is a consolidation on the market, because the level of 1.34 is a psychological level of resistance. The breakdown and consolidation higher than 1.34 will open a way for the EUR/USD pair to the level of 1.35, and upper border of the descending long-term trend.

The fall line of business activity that was formed on a daily graph is a significant resistance. However, we do not think that the market will consolidate higher than this weekly trend line, because European Union many problems at the moment. If the Federal Reserve System does not give efficient solutions on ending the softening politics and does not consider such a solution in the near future, then the European currency will fall very soon. Moreover, one should be very concerned with the state of European stock markets. Right now MIB, IBEX, FTSE, and CAC look very vulnerable.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3900

Expect significant resistance near levels of 1.34.

For EUR/USD pair the session of Tuesday was successful, despite the fact that at the beginning the pair was lowering slightly, but as a result it closed higher than the level of 1.33. Even if you do not like Euro you should not ignore the fact that market is ascending and it is what a trader should know. With the break of maximum formed on Tuesday one should buy a pair and get short-term profits. As you can see we are singling out red lowering line of the trend which is based on long-term daily graph.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3816

EUR/USD – have had a long walk, so what?

The money on the table

All the commentaries of ECB about yesterday’s session seemed optimistic for investor, but they weren’t so. Now we are following the ascending trend abc, which is corrective movement in relation to previous bear impulse. In case of growth renewal a maximal value is expected at the level of 1.3350. In general a fall to the following boundaries is expected:

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3486

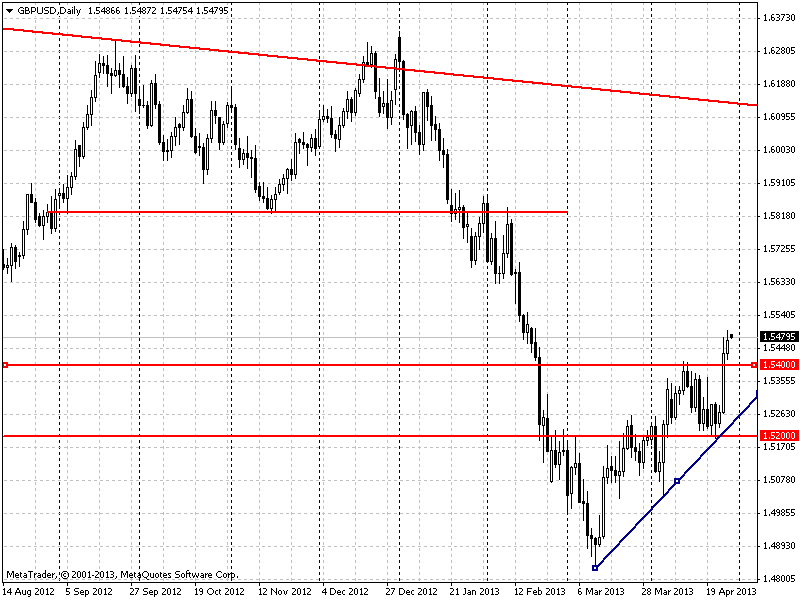

The main levels of support and resistance of the pair of GBP/USD for Thursday, June 6 2013

Forex analytics

Yesterday pound sterling made investors happy by positive behavior, after publishing a range of news: manager index for PMI for service grew by 54.9 over May, when 53 had been planned earlier. As a result pound sterling remained between levels of 1.5301 and 1.5381, a possible point of deployment is at the level of 1.5352. now we are watching closely attempts of the pair to overcome the resistance of 1.5413, it is from this point that the growth is happening to the level of 1.5431, further 1.5442 and 1.5470.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3100

The trade on Friday reminded a real battle for the positions. Publication of a range of negative fundamental data of Eurozone and more optimistic US news helped to consolidate dollars and in euro descent. As a result the day ended in dollar growth by 52 points, the volatility of tradings turned out to be 114 points.

Federal bureau of statistics of Germany showed a decrease in sales in April by 0.4 %. New data about the unemployment in Eurozone reached another maximum of 12.2 %, when in March it was 12.1 %.

The situation is developing as it was planned by analysts. Preliminary valuation of Eurozone inflation in annual basis is ¼ %. ECB determined the aim level up to 2 %, so there is still time to make several effective decisions.

The mood on US market is still positive. That can be seen on University of Michigan Consumer Sentiment Index, which grew to 84.5 in May, while in April it was just 76.4.

Analysis of technical situation: Now the currency pair is trading at the level of 1.3000, while it is making attempts to break down this resistance. Despite the fact that the trades are conducted in a positive mood, the bulls are the main players, the rate is still in low near 1.2837 and 1.2943.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3547

EUR/USD

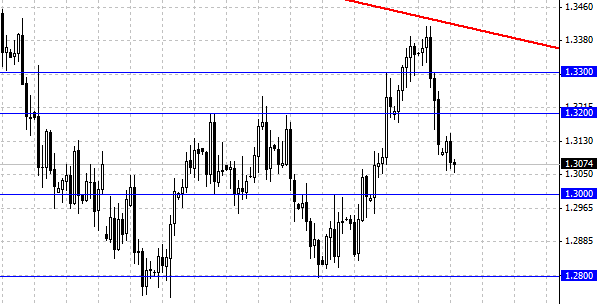

Pic. 1. Daily graph

Currency pair EUR\USD is still under the resistance of levels of 1.3010 and 1.3075. Here we are watching the stabilization of 50-, 100- and 200-daily SMA. In that case one should expect the rehabilitation of descending tendency after passing the mark of 1.2745 and fall of the currency to 1.2660, where most likely the consolidation will be. If the bears take over the situation, a strong descent to the level of 1.2040 is planned.

The deployment of the market is considered in case of passing the barrier of resistance at the levels of 1.3010 and 1.3075 and the growth of currency pair to the level of 1.3200. Then a strong bursting and movement upwards to the level of 1.3710 is possible.

The main technical levels are: 1.3178, 1.3129, 1.3110, 1.3068, 1.3050, 1.2977, 1.2956 и 1.2917.

To open long positions is recommended with the rate 1.3068 and to close it at the level of 1.3110, further from 1.3130 to 1.3175. It is better to sell from 1.2975 to 1.2957, further from 1.2950 to 1.2917.

GBP/USD

Pic. 2. Daily graph

Currency pair is trading within the diapason of 1.5200. Investors make bets on currency growth to the level of 1.5300, this is how 50- and 100-daily SMA are placed. In case of positive developments there might be a steady growth to the 1.5600. Otherwise we are going to see the following situation: the lowering of currency to the level of 1.5000 to the level of 1.4830.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3482

This month gold market does not look very promising in terms of movement stability. The market certainly will react strongly to the news and will stay a hostage of Federal Reserve system statement as during the session on May 22. Mere mentioning the possibility of retreat from part of the program of quantitative easing brought massive panic attack to the market during the day. Because of that the gold market dropped and US dollar became more powerful.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3719

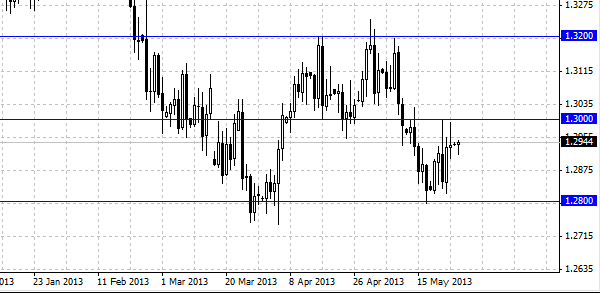

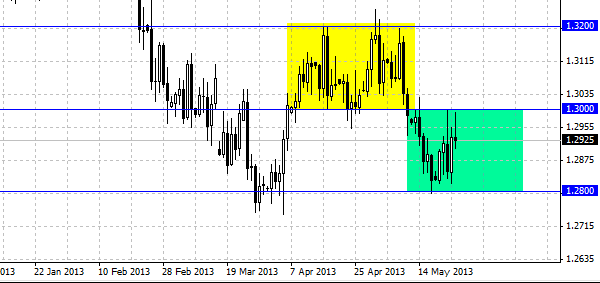

Investors leave EUR/USD

European currency continued to move in a side trend during the week, 1.28 and 1.30 levels still keep the markets. At the moment the EUR/USD pair is not going to fall abruptly, the adjustment towards the level of resistance of 1.32 became more likely. This wide diapason can last the whole summer, because the liquidity on the market is lessening due to vacations and summer holidays. That is why we believe that long-term traders had better leave the market, short-term traders are in a better position, because they have more opportunities.

As a short term trading of the pair EUR/USD, we recommend opening short positions, when the price is near the level of 1.30 with the aim of 1.29. If the price of European currency continues to grow higher than 1.30, then it is worth buying the currency with short-term aim of 80-100 points.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3666

EUR/USD currency pair as we assumed grew on Tuesday. The support formed at the level of 1.28 looks very strong and it is hard to imagine that it will be broken. It is especially noticeable in a long-term timeframes that this area is a restraining factor for the future lowering of the pair. That is why in order to break this level it is necessary that the quantity of traders who are selling short grow significantly which will allow calling forth the necessary pressure.

The 1.30 level is still the upper bound of the channel that had been formed, 200 points wide. Nevertheless such tendency should not last long, now this market for short-term traders is making the situation worse and the lack of certain information from Europe. The players forgot about Europe and concentrate on information coming from the US, but it is a question of time, any important information from Europe will give the market the necessary push which will move the EUR/USD pair from the diapason that was formed. We recommend you to pass from daily graphs to hourly for the possibility to earn on short-term deals within the diapason.

The risk is high that the market for EUR/USD pair entered the “summer” diapason that can be observed in a wider channel between the levels of 1.28-1.32, with the middle at a level of 1.30. By using this information one can divide the market into two blocks trading in a higher and lower parts. With summer months the liquidity starts to disappear and one should not expect more than a quick short-term trade. In summary the traders should follow the news, coming from Europe and the USA, we still assume that at the end the pair has a negative dynamics and checking the strength of 1.28 level is a question of time.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3622

How far north can the Euro go before falling again?

The EUR/USD pair began the week with a technical rebound after falling to the psychological level of 1.28, the rebound can continue until the nearest level of resistance of 1.30 which in our opinion seems hard to reach for investors who have long positions. One should not forget that euro has its own set of problems and the power of US dollar which is characterized by renewal of American economy will be lowering the euro in the long run. US dollar rally will continue most likely that is why the correction of the pair of EUR/USD gives the opportunity to traders to open short positions. In our opinion the most important goal for the pair is the level of 1.27, reaching of which can throw the European much currency lower.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3804

The trading week started two minutes ago. Despite the fact that former USSR countries are celebrating the labor day this week, all the foreign markets are working during the labor day, that is why when planning the week one should take into account this fact. May 1-st will bring serious news factor from the USA – a meeting of FOMC with following comments will take place.

Meanwhile Soviet people are preparing for the holiday, Pound sterling is looking for strength and support to consolidate its luck, after passing the level of resistance of 1.5400 of USD. A great luck for traders who passed the breakdown of level of resistance will be entry into long positions on GBPUSD if the rebound occurs from the 1.5400 level if there is a correction to current growth. However there is a possibility that this correction will not occur.

EURUSD is not so active and strong, but the pair is moving towards the top. However EURO course is gripped in the boundaries of two levels of 1.3000 and 1.3140 within which the pair is heading towards trading. If the quotations do not leave this level one should not enter the position on EURUSD.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3562

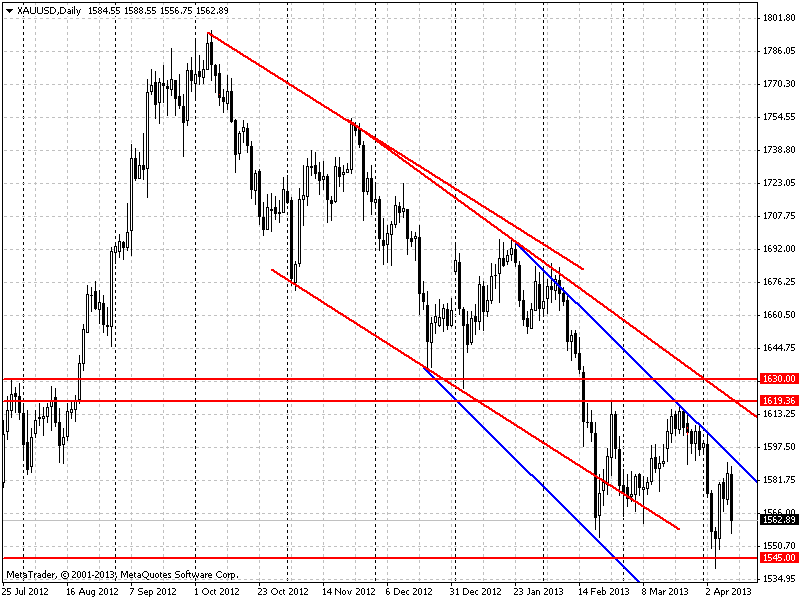

High volatility on Friday and abrupt movement on goods market could bring many ills to a beginning trader. Besides the petroleum which is called “black gold”, real gold fell as well and fell deep.

Gold fell almost down to the lower border of the channel. On Monday the question about whether the quotations break down the channel or not will become urgent. The pace of developments will depend on it.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3803

During the first part of this week Euro, pound sterling, gold have been growing and rehabilitating from local downs. On Wednesday market situation started changing towards continuation of descending trends on these tools.

If one looks at more logical situations from technical analysis point of view, the movement of quotations on gold is very clear. On Wednesday gold quotations rebounded from slant line of the trend, so the daily decline overlapped the previous growth.

It seems like the situation must demonstrate the continuation of the descending trend, but it is not the case.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3566

The market is opening on April the first, seriously. That is why one should get ready thoroughly, so that there is no hysterical laughter later.

There is a descending trend on EURUSD pair due to all the known reasons (it is all due to distrust towards the European banking system, it became too dangerous to have your money there).

A small attempt to break down the level of resistance of 1.3300 at the beginning of the week turned out to be unsuccessful, which led to a “fake” bull signal, which demonstrated clearly that a descending trend is not over.

A good support is 1.2700. The price is now close to that level but there is still a range, that is why one should not worry about entering into the sales now.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3691

Due to controversial decisions of EU concerning the Cyprus problem, the European currency has been under the pressure of restless traders during last weeks.

Restless traders on their part raised the interdaily volatility on EURUSD pair, which gives way to “hunt for stops” and “bear and bull traps”.

Under such conditions there are “fake” technical signals on the pair, some fake breakdown of the resistance of 1.3000 this Monday after which a fast descent to the current level occurred. The quotations are at their minimum right now for the last months, but it does not give you a good signal to enter positions.

The increased volatility makes the risks for the deal higher and the potential profits are not clear yet, that is why it is better to keep neutrality for this pair.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3445

The first half of the first spring month is over for northern hemisphere, and the market began changing. Along with longer daylight hours and the sun which is brighter, market stopped falling and they demonstrated first signs of renewal. Is the spring connected with market rehabilitation? Probably yes, since people are more optimistic about their life during spring and thus about the economy, as a part of it.

The first half of March EURUSD pair was fighting for the opportunity not to fall. The fights were held at the level of support and round psychological level – 1.3000. The diapason of “battles” was restricted from above by the level of support of 1.3140.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3539

The main question of the week is: will the global descent stop? Will we try to find signs of the end of descending trend or even the deployment if we are lucky enough? No, we will be looking at graphs without bias.

Euro which has looked pretty good compared to USD, fell last week, breaking down the support of 1.3300 and ascending slant line of the trend in the same place. There is a very good signal for selling the EURUSD pair. Especially if one looks more closely it will be possible to see a classic graph figure “Head and shoulders” which was formed in a daily graph from the middle of January until the middle of February.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3624

The new trading week is here. It is going to be interesting again. We are going to discuss what to pay attention to first.

Clearly we won’t be able to do so without the retrospect into the last week.

The first mystery of the current week – whether the consolidation on gold will be over, which reminds convergent triangle? And in case it is over, where will the break occur? Up? Or Down?

At the moment the gold quotations deceitfully move towards lower bound of the triangle, however it can be an erroneous sign of weakness of gold. It is worth waiting patiently and attentively for the break of triangle and entering only the next day after the break.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3577

First, USDJPY is pretty confident, it has been growing steadily since the start of October 2012. On its way of intensive growth the pair made short term adjustment descents. But they do not influence the common background of perfect growth.

Everything is so clear on USDJPY that it is hard to believe. Although it is in vain one should enjoy the drive, the first restriction of which is at 95 000.

The opposite situation is on pound sterling. It is very weak and has been lowering compared to dollar for two months while euro has been growing.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3234

Last week GBPUSD pair demonstrated serious descent. On Friday on the day of adjustment of all the currency anti-dollar pairs, pound sterling approached American currency closer than any other days of the week. GBPUSD pair broke down the level of support of 1.5915 and closed trading week lower than the given level, almost approaching local minimum of 1.5825.

If one is not searching for fundamental reasons of such intensive descent, technically there are no reasons to buy, since the signal for a rebound can be formed only in case of a rebound from the level of support. There is no such signal yet, and the trend is clear.

Next week a little adjustment of current fall is most likely to occur. Whether this adjustment is a deployment, will be possible to tell only after seeing it.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3205

First of all we should mention the fact that first two weeks of 2013 happened to be pretty volatile for Forex. Such activity is a little bit strange, because the direction of market has changed within two weeks. First week began with the growth of dollar but current week ended in reverse movement. Let’s look at the current situations and probable development of every given tool.

EURUSD pair, which lowered significantly when 2013 started, grew considerably on 10-th and 11-th of January, due to positivity of Eurozone, and closed higher than previous maximum- 1.3300. Thus, ascending trend has to continue in the same torn manner. A great entry into long positions on EURUSD will be the moment of rebound from 1.3300 support on Monday, if that happens. Next serious resistance of 1.3500, which is slightly higher than maximum of 2012, which makes current resistance very important.

GBPUSD pair did not look strong enough and pound sterling could not even return to its resistance of 1.6300. Currently the pair is between the levels, and it is tough to discuss the forecast of movement. Graphically the return to descending movement to the support of 1.5919 is visible, but if the EURUSD pair keeps growing, GBPUSD pair will not be capable of descending so low.