- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3774

EUR/USD in expectation of FOMC

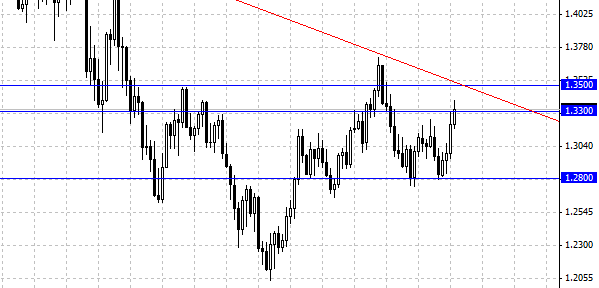

EUR/USD pair grew in price during the last week and it was able to consolidate higher than the level of 1.33. However, our graphs demonstrate the line of resistance which should implement the pressure on EUR/USD pair closer to the end of the week. There are several candle-hummers on a daily graph in succession, thus we assume that the next week will be a Euro week. Undoubtedly, the market is expecting the Federal Reserve system press conference, which will happen in the second half of the week. The results of the meeting will determine the destiny of US dollar, whether the chairman of the DRS announces a program of quantitative easing or no. But we consider that the traders will prefer waiting for the closure of the candle on the day of the press conference. However it is obvious that one should buy EURO higher than the line of tendency and sell it lower.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3691

EUR/USD pair dropped at first lower than the level of 1.33 during the session on Thursday, but as you can see it grew significantly to form hummer-shaped candle again. This is the second hummer in succession, and in most cases it means an optimal action. Now the level of 1.33 looks as a quite strong support on the market, and as a result we think that the tendency for growth for Euro will remain. However, there is a line of fall of European currency on a weekly graph, which can demonstrate a significant resistance. Besides, it should be noted that distinct European indexes look absolutely terrible. It is especially true in terms of such peripheral countries as Spain, Italy, Greece. News and economic data from Europe will most likely shoe negative development which will keep a strong growth.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3402

To buy or not to buy?

After opening with the descent on Monday, EUR/USD pair gave the signal to sell, the level of 1.3250 kept the growth of the pair on Friday, nevertheless, the pair was stuck at the support level, which now became the level of 1.3200, and investors who were hoping for the euro to fall, had to destroy their positions. The pair strong growth after the rebound from the support affected a newly formed level of 1.3250 and now we see how EUR/USD is trying to consolidate higher than the level of 1.3300. The speed with which the European currency is moving is demonstrating the signs of rally that we can witness in a short-term perspective. Eventually we think that the pair will consolidate higher than the level of 1.33, now it is high time to open the deals for purchase.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3541

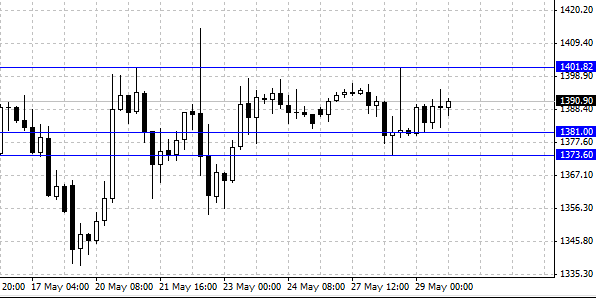

XAU/USD pair is in the side movement, upper bound is at the level of 1400 and is restraining growth of gold. Yesterday trade was not different from the previous 9 days. The pair reached 1401.81 level, but afterwards it retreated to the level of 1381 – which is currently a local minimum. American data demonstrated that consumer confidence index has grown to 76.2 from 69, as shown in report from S&P's, real estate price index grew by 10.9%. On the one hand we see bull pressure from stock market that has grown in power, low expectations of inflation all over the world and great economic data from the USA, and on the other hand precious metals find support due to increasing demand, which is formed by Asia and Central Banks, after lowering of the price of assets by ¼. That is why traders should wait a little bit while the market gives signal for closure of this hard market. The key levels in near-time outlook are 1400 and 1373.60. The breakdown of the level of 1400 and keeping it higher on a 4- hour graph will be a good signal for bulls.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3384

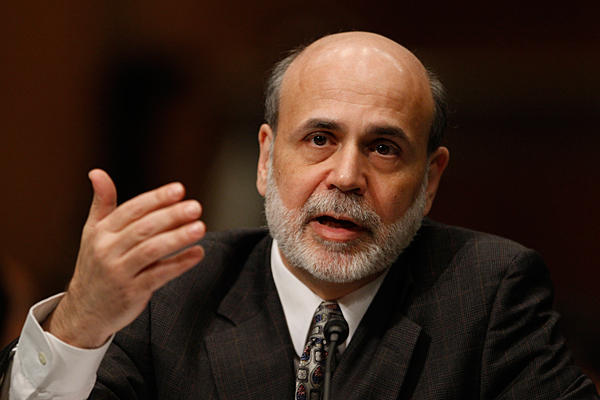

EUR/USD pair was working on its technics on Wednesday. You can see that the pair was moving towards the level of 1.30 and it meta strong resistance there. In a weekly review we assumed that the market would experience difficulties when moving higher than this area, but we have to acknowledge that we are surprised how precise was our assumption. 1.30 level is a strong resistance, but Be Bernarke’s remarks helped to keep the pair from following growth, he did not exclude the possibility to begin removing the politics of quantitative softening during the following several months. It is not important because the following movement of the EUR/USD pair is uncertain.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3634

From the start of current week EURUSD tried to descend. On Monday the descending trend was pretty evident and didn’t give rise to doubt. But on Tuesday after crushing support level of 1.3500, EURUSD pair grew.

Thus the descending movement ended and now there is a signal for purchasing the pair, since after the “fake” breakdown of support Euro can continue its growth towards new resistance situated at 1.4000.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3337

After breaking down the level of support of 88.000 last week and passing higher than this level, this week the pair USDJPY adjusted to this level- support of Wednesday, and after failed attempt to break down this support lower on Thursday it pushed off from it strongly, by renewing local maximum by 89.700.

Currently this phenomenon demonstrates that there is a strong continuing ascending trend on USDJPY pair and it is very dangerous and not profitable to trade against the trends. Keeping long positions on the pair brings great profits and it allows pulling stop loss which determines part of the income from time to time.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3438

As it was stated earlier in a weekly premarket review on Sunday, there is a very interesting situation on gold. The quotations of gold are in trading diapason of 1636 – 1677 dollars for Troy ounce, and there were three attempts to reach lower bounds of quotation within a month stay in the trading diapason. It means that in case of descent of quotations lower than 1650, gold will be actively bought by traders and 1636 is a potent support.

Quotations often reach upper bound. A fake breakdown occurred during first days of 2013. A fake breakdown could be a fake signal to buy, which proves the usefulness of abstention from trading during New Year and Christmas. The error was quickly fixed by pretty powerful movement, which returned inside a trading diapason fast.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3978

Last week destroyed bulls’ hopes to continue the ascending tendency on the market. The correction of the growth goes on but the question remains: is the descending movement a correction or we are looking at the deployment of the market? Meanwhile the markets are falling and this goes on. It is not essential whether it is a deployment or the correction, since there are no signals for purchase.

One of the weakest currency pairs (as usual) was EURUSD pair that moved away from euphoria connected with quantitative easing in the US and a great ransom of government bond in Eurozone. Now after a quick growth the pair is lowering on a daily basis and the first stop might be a level of support of 1.2750. Interestingly enough the correction level of Fibonacci is the same of 38%. That is why it is possible to keep short positions on euro dollar up to this mark or to open new sales. Future of the movement of EURURSD pair quotations will be determined on 1.2750.

Tuesday-Wednesday of this trading week were decisive for British pound and gold.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3724

As we wrote yesterday euro is under the pressure of bad news and hence it is descending. On Thursday under the pressure of fresh news on Great Britain deficit growth and ECB forecast descent of European economy development in 2012 (ECB is planning the economy descent by 0.3 %) euro broke down the level of support by 1.2320, from which on Wednesday a rebound of pair quotations was realized.

This breakdown is a perfect technical example of the fact that there is a pessimistic sentiment on the European market of union currency and the quotations must descend. With such negative background and technical weakness of Euro it will possibly descend to 1.2180-1.2210, where a short stop will occur and the bulls will have the opportunity to change the progress of events that are developing currently negatively for euro, which might drop lower than the current minimum for this year.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3423

As we have stated several times there is a strong connection between Australian dollar rate and economic situation of raw materials market. The higher the oil price the higher Australian dollar rate is.

So it did not come as a big surprise when AUDUSD pair decreased today with oil. The corrections of oil might continue for indefinite time, but the ascending trend is still on and consequently it is necessary to start looking for entry points to the market with purchases on AUDUSD pair.

- Details

- Written by Jeremy Stanley

- Category: Forex forecasts

- Hits: 3883

While everybody was guessing if EURUD pair will be able to return to its previous trading range of 1.2320 – 1.2660, the euro suddenly dropped to the minimal value this year- the closing price on Friday 1.2155.

Certainly the EURUD pair dropped for a reason. And the reason was significant- negative news. As we have stated many times, the markets and especially the euro currency market reacts very actively to any negative news. And on Friday there were 2 reports. The first one: growth retardation of Germany, the country which is the engine of Europe. The second one: unsuccessful allocation of 10-year state obligations of Spain, which weren't popular among investors even at 7% (the maximum value of obligations profitability lately).

- Details

- Written by Admin

- Category: Forex forecasts

- Hits: 4114

In May dollar was save haven currency and the worse the better rule was applicable. It means that usually bad news could cause the growth of dollar.

It shows that dollar is strong as a reserve currency. But news about the level of unemployment in the USA, which was expected to stay at the same level (8%) changed to 8,2%.

- Details

- Written by Admin

- Category: Forex forecasts

- Hits: 3948

Recently gold market has been risky and market volatility unpredictable. Gold was at 1545 in May but there was a fast growth on the June 1 after the bad news from the USA and lack of investors, who were scared of the risks and left the scene. In next few days the rates became consolidated.  On the 6th of June gold pushed resistance at 1631, but not higher. Positive comments on eurozone recovery of the ECB president caused to the fall of gold and as a result of this investors who left the market on June 1 started selling it in order to enter the market.

On the 6th of June gold pushed resistance at 1631, but not higher. Positive comments on eurozone recovery of the ECB president caused to the fall of gold and as a result of this investors who left the market on June 1 started selling it in order to enter the market.

Page 2 of 2