- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2855

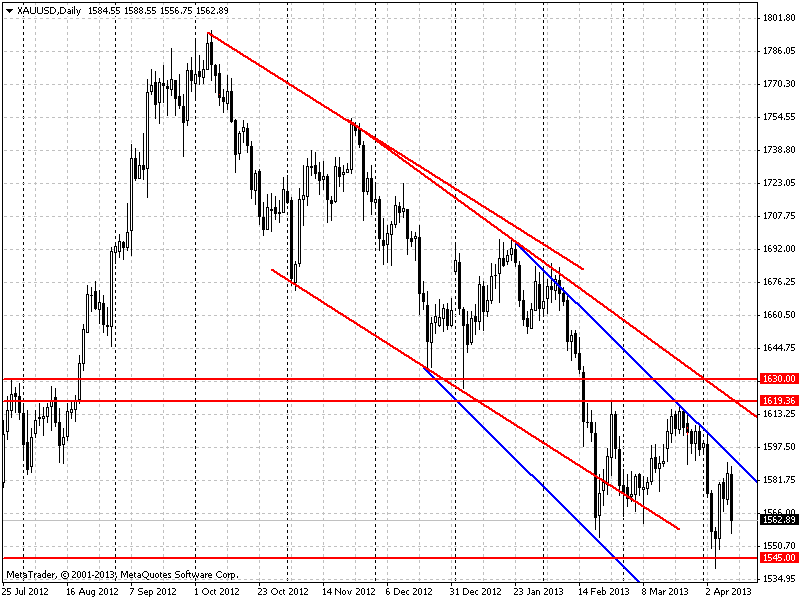

This month gold market does not look very promising in terms of movement stability. The market certainly will react strongly to the news and will stay a hostage of Federal Reserve system statement as during the session on May 22. Mere mentioning the possibility of retreat from part of the program of quantitative easing brought massive panic attack to the market during the day. Because of that the gold market dropped and US dollar became more powerful.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3096

Investors leave EUR/USD

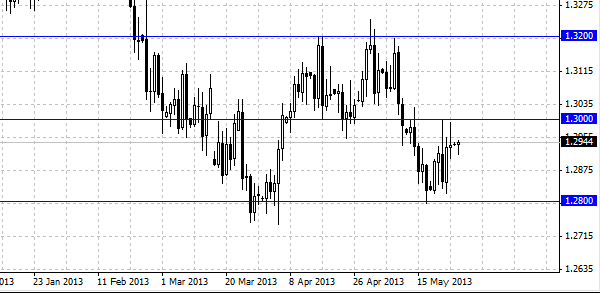

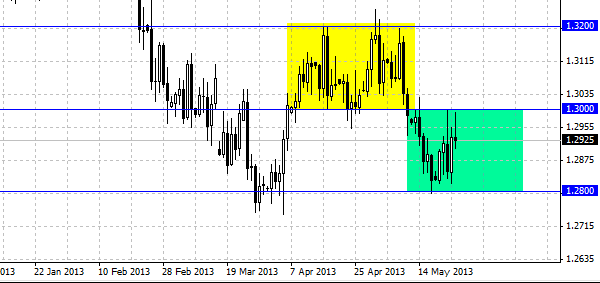

European currency continued to move in a side trend during the week, 1.28 and 1.30 levels still keep the markets. At the moment the EUR/USD pair is not going to fall abruptly, the adjustment towards the level of resistance of 1.32 became more likely. This wide diapason can last the whole summer, because the liquidity on the market is lessening due to vacations and summer holidays. That is why we believe that long-term traders had better leave the market, short-term traders are in a better position, because they have more opportunities.

As a short term trading of the pair EUR/USD, we recommend opening short positions, when the price is near the level of 1.30 with the aim of 1.29. If the price of European currency continues to grow higher than 1.30, then it is worth buying the currency with short-term aim of 80-100 points.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3049

EUR/USD currency pair as we assumed grew on Tuesday. The support formed at the level of 1.28 looks very strong and it is hard to imagine that it will be broken. It is especially noticeable in a long-term timeframes that this area is a restraining factor for the future lowering of the pair. That is why in order to break this level it is necessary that the quantity of traders who are selling short grow significantly which will allow calling forth the necessary pressure.

The 1.30 level is still the upper bound of the channel that had been formed, 200 points wide. Nevertheless such tendency should not last long, now this market for short-term traders is making the situation worse and the lack of certain information from Europe. The players forgot about Europe and concentrate on information coming from the US, but it is a question of time, any important information from Europe will give the market the necessary push which will move the EUR/USD pair from the diapason that was formed. We recommend you to pass from daily graphs to hourly for the possibility to earn on short-term deals within the diapason.

The risk is high that the market for EUR/USD pair entered the “summer” diapason that can be observed in a wider channel between the levels of 1.28-1.32, with the middle at a level of 1.30. By using this information one can divide the market into two blocks trading in a higher and lower parts. With summer months the liquidity starts to disappear and one should not expect more than a quick short-term trade. In summary the traders should follow the news, coming from Europe and the USA, we still assume that at the end the pair has a negative dynamics and checking the strength of 1.28 level is a question of time.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3025

How far north can the Euro go before falling again?

The EUR/USD pair began the week with a technical rebound after falling to the psychological level of 1.28, the rebound can continue until the nearest level of resistance of 1.30 which in our opinion seems hard to reach for investors who have long positions. One should not forget that euro has its own set of problems and the power of US dollar which is characterized by renewal of American economy will be lowering the euro in the long run. US dollar rally will continue most likely that is why the correction of the pair of EUR/USD gives the opportunity to traders to open short positions. In our opinion the most important goal for the pair is the level of 1.27, reaching of which can throw the European much currency lower.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3195

The trading week started two minutes ago. Despite the fact that former USSR countries are celebrating the labor day this week, all the foreign markets are working during the labor day, that is why when planning the week one should take into account this fact. May 1-st will bring serious news factor from the USA – a meeting of FOMC with following comments will take place.

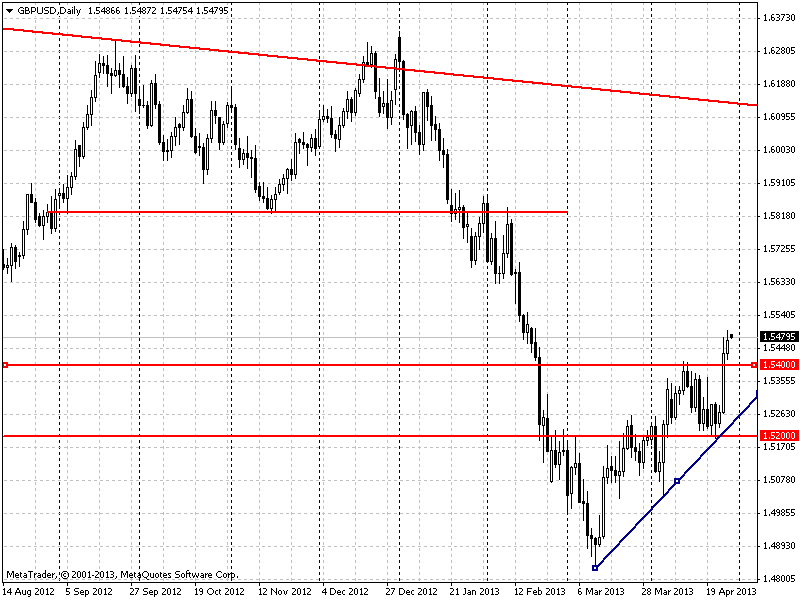

Meanwhile Soviet people are preparing for the holiday, Pound sterling is looking for strength and support to consolidate its luck, after passing the level of resistance of 1.5400 of USD. A great luck for traders who passed the breakdown of level of resistance will be entry into long positions on GBPUSD if the rebound occurs from the 1.5400 level if there is a correction to current growth. However there is a possibility that this correction will not occur.

EURUSD is not so active and strong, but the pair is moving towards the top. However EURO course is gripped in the boundaries of two levels of 1.3000 and 1.3140 within which the pair is heading towards trading. If the quotations do not leave this level one should not enter the position on EURUSD.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3009

High volatility on Friday and abrupt movement on goods market could bring many ills to a beginning trader. Besides the petroleum which is called “black gold”, real gold fell as well and fell deep.

Gold fell almost down to the lower border of the channel. On Monday the question about whether the quotations break down the channel or not will become urgent. The pace of developments will depend on it.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3151

During the first part of this week Euro, pound sterling, gold have been growing and rehabilitating from local downs. On Wednesday market situation started changing towards continuation of descending trends on these tools.

If one looks at more logical situations from technical analysis point of view, the movement of quotations on gold is very clear. On Wednesday gold quotations rebounded from slant line of the trend, so the daily decline overlapped the previous growth.

It seems like the situation must demonstrate the continuation of the descending trend, but it is not the case.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2985

The market is opening on April the first, seriously. That is why one should get ready thoroughly, so that there is no hysterical laughter later.

There is a descending trend on EURUSD pair due to all the known reasons (it is all due to distrust towards the European banking system, it became too dangerous to have your money there).

A small attempt to break down the level of resistance of 1.3300 at the beginning of the week turned out to be unsuccessful, which led to a “fake” bull signal, which demonstrated clearly that a descending trend is not over.

A good support is 1.2700. The price is now close to that level but there is still a range, that is why one should not worry about entering into the sales now.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3097

Due to controversial decisions of EU concerning the Cyprus problem, the European currency has been under the pressure of restless traders during last weeks.

Restless traders on their part raised the interdaily volatility on EURUSD pair, which gives way to “hunt for stops” and “bear and bull traps”.

Under such conditions there are “fake” technical signals on the pair, some fake breakdown of the resistance of 1.3000 this Monday after which a fast descent to the current level occurred. The quotations are at their minimum right now for the last months, but it does not give you a good signal to enter positions.

The increased volatility makes the risks for the deal higher and the potential profits are not clear yet, that is why it is better to keep neutrality for this pair.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2857

The first half of the first spring month is over for northern hemisphere, and the market began changing. Along with longer daylight hours and the sun which is brighter, market stopped falling and they demonstrated first signs of renewal. Is the spring connected with market rehabilitation? Probably yes, since people are more optimistic about their life during spring and thus about the economy, as a part of it.

The first half of March EURUSD pair was fighting for the opportunity not to fall. The fights were held at the level of support and round psychological level – 1.3000. The diapason of “battles” was restricted from above by the level of support of 1.3140.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3016

The main question of the week is: will the global descent stop? Will we try to find signs of the end of descending trend or even the deployment if we are lucky enough? No, we will be looking at graphs without bias.

Euro which has looked pretty good compared to USD, fell last week, breaking down the support of 1.3300 and ascending slant line of the trend in the same place. There is a very good signal for selling the EURUSD pair. Especially if one looks more closely it will be possible to see a classic graph figure “Head and shoulders” which was formed in a daily graph from the middle of January until the middle of February.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3076

The new trading week is here. It is going to be interesting again. We are going to discuss what to pay attention to first.

Clearly we won’t be able to do so without the retrospect into the last week.

The first mystery of the current week – whether the consolidation on gold will be over, which reminds convergent triangle? And in case it is over, where will the break occur? Up? Or Down?

At the moment the gold quotations deceitfully move towards lower bound of the triangle, however it can be an erroneous sign of weakness of gold. It is worth waiting patiently and attentively for the break of triangle and entering only the next day after the break.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2952

First, USDJPY is pretty confident, it has been growing steadily since the start of October 2012. On its way of intensive growth the pair made short term adjustment descents. But they do not influence the common background of perfect growth.

Everything is so clear on USDJPY that it is hard to believe. Although it is in vain one should enjoy the drive, the first restriction of which is at 95 000.

The opposite situation is on pound sterling. It is very weak and has been lowering compared to dollar for two months while euro has been growing.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2687

Last week GBPUSD pair demonstrated serious descent. On Friday on the day of adjustment of all the currency anti-dollar pairs, pound sterling approached American currency closer than any other days of the week. GBPUSD pair broke down the level of support of 1.5915 and closed trading week lower than the given level, almost approaching local minimum of 1.5825.

If one is not searching for fundamental reasons of such intensive descent, technically there are no reasons to buy, since the signal for a rebound can be formed only in case of a rebound from the level of support. There is no such signal yet, and the trend is clear.

Next week a little adjustment of current fall is most likely to occur. Whether this adjustment is a deployment, will be possible to tell only after seeing it.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2609

First of all we should mention the fact that first two weeks of 2013 happened to be pretty volatile for Forex. Such activity is a little bit strange, because the direction of market has changed within two weeks. First week began with the growth of dollar but current week ended in reverse movement. Let’s look at the current situations and probable development of every given tool.

EURUSD pair, which lowered significantly when 2013 started, grew considerably on 10-th and 11-th of January, due to positivity of Eurozone, and closed higher than previous maximum- 1.3300. Thus, ascending trend has to continue in the same torn manner. A great entry into long positions on EURUSD will be the moment of rebound from 1.3300 support on Monday, if that happens. Next serious resistance of 1.3500, which is slightly higher than maximum of 2012, which makes current resistance very important.

GBPUSD pair did not look strong enough and pound sterling could not even return to its resistance of 1.6300. Currently the pair is between the levels, and it is tough to discuss the forecast of movement. Graphically the return to descending movement to the support of 1.5919 is visible, but if the EURUSD pair keeps growing, GBPUSD pair will not be capable of descending so low.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3062

On Monday USD was getting cheaper compared to euro currency. Thus, pound sterling added 50 points to USD and it overcame the resistance of 1.6180, and it will most likely stay higher after the end of session. Which is a bull signal to buy GBPUSD pair.

The aim of the ascending movement of the pair GBPUSD is above the resistance of 1.6300, which is a strong resistance, since the pair is above this level since august 2011.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2913

The upcoming week is the last active trading week this year. The Christmas and new year holidays are approaching. That is why next week might bring some surprises.

EURUSD pair consolidated above the resistance level 1.3140, which is the signal to continue the growth, which is restricted by resistance level of 1.3500.

GBPUSD pair was set against the local maximum 1.6180 at the end of the week. The conquering of this level will make way to resistance 1.6300 for the pair. The ascending trend on the pair still exists.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3069

The most important even of the week is the deployment of dollar compared to euro currency. Namely euro currency (euro as well as pound sterling), since other currencies grew compared to dollar during the week. Thus, leading economies continue losing their positions on the market, while raw materials market and developing markets grow.

The development of EURUSD was very smooth. On Wednesday the pair couldn’t reach and pass the resistance level of 1.3140 and it moved downwards. (Now we are not talking about fundamental reasons of this movement, which was provoked by changes in the forecast of development of Eurozone by the central bank). A good fall on Thursday ended with finding local bottom on Friday, and the correction from it was made to current fall on Friday.

Since there aren’t any signals for deployment (and even for Н4), the descending trend is still the current trend for sales. Its potential for fall is reaching 1.2825, where the lower bound of trading diapason, that was actual in September-October, is. The signal for entering into sales (for those who are not in the market right now) will be a gap down at the opening.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 4599

After a month’s growth on Thursday December 6-th EURUSD fell abruptly. Before the fall there was a rebound from the level of resistance of 1.3140. The fall on Thursday supported the deployment, which was indicated at by “hammer” on Wednesday.

Now the quotations of pairs reached the area of previous consolidation, that can support the falling pair on Friday. Probably the level of consolidation will allow the pair stopping for a short break and might support it, which may turn the descending impulse into consolidation or even the deployment.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3011

A good trend on EURUSD that started from 1.2660 will face a serious obstacle soon- resistance of 1.3140. Earlier (in September and October) EURUSD pair made two attempts to overcome this level of resistance, but both ended unsuccessfully.

First two trading days of this week were very successful for euro and the fast growth is continuing. However along with the growth the possibility of technical correction increases, which may be provoked by indicated level of resistance.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2618

Last week was not easy for the marker. On Thursday the USA celebrated Thanksgiving Day and the exchanges did not work, which changed the trading patterns of Thursday and Friday was very prone to risk.

The “Black Friday” was also held on Friday in the USA. Probably its results (there is an increase in purchases from the last year) influenced the traders and investors’ ability to risk.

So what should one expect from next week? The negative factor for the market is lack of results on outcome of the negotiations of EU countries at the summit. The decision concerning the budget will be taken during next months, since the “providers” of EU can’t agree to spend their money on needs of others. This factor might change the ascending trend that developed last week.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2934

Wednesday was ambiguous for forex and the tools were differently directed, but let’s take EURUSD pair, as the most popular and interesting one. At first at night there was a small rebound from the resistance level of 1.2825, and the bears started packing their portfolios with short positions, but during the day and at the end of the day EURUSD pair decided to test the durability of resistance level of 1.2825.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2799

Last week USDJPY pair descended abruptly. We have warned about probable “misbehavior” of this pair and about the unjustified low interest in this pair among the traders. After a small consolidation USDJPY pair fired and continued its impulse on Thursday. On Friday along with the weakening of the dollar and the stop of the fall of share market in the US, USDJPY pair demonstrated more modest growth.

However the future of quotations of this currency pair isn’t clear. There are no technical obstacles for the development of the ascending trend, except for the custom among traders to buy yen. The pair passed the mark of resistance of 80.54 On Thursday , the breakdown was easy and quick, which says a lot about the strength of the impulse. Thus there are no reasons to think that USDJPY pair will not be able to function in the same manner for two more days. Certainly it will be illogical to exclude he short correction. However one should sell something that is obvious, which is the growth.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2915

Two working days of a trading week are over. They were pretty boring but at the same time interesting for Forex market. It is high time to make changes in trading strategy on several tools.

EURUSD pair made a stop in the descending trend, rebounding from support of 1.2660 on Tuesday. However according to classic analysis the stage of correction towards fall or renewal has to start now. Candlestick analysis is another indicator of that, since the candle from Monday has a very tiny body which means that on Monday the trading was even. Tuesday was more volatile but the descend at the beginning of European session ended in renewal at the end of the day. Thus there are some premises for short-term deployment. The entry into long positions from 1.2700 is justified based on profit/risk. Since the aim of this beginning movement can be the level of resistance 1.2830, and the restriction of profits is very limited- the support of 1.2660.

The current situation on pound sterling based on two trading days does not look promising. GBPUSD pair could not find the support on Tuesday, however there were attempts to restore the quotations with the news. There is no signal for action for this pair. However taking into account the high correlation between GBPUSD and EURUSD pairs, one can assume that there is a possibility of appearance of the signal to buy on Wednesday. That is why one should not occupy any positions on GBPUSD pair until active trading on Wednesday.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3018

Bad news from Eurozone do not allow euro to compete with dollar, as pound sterling does. Yesterday’s attempt to break down the resistance of 1.2830 failed, since all the hopes for the recovery of quotations of European currency were destroyed by ECB president M. Dragi with his not so positive speeches and high unemployment in the region (approximately 11,5%) and a huge unemployment in Greece (24,5 %) and Spain (24,8%).

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2989

On Friday growth in dollar as well as fall of share markets have occurred in the US. There are many reasons for that: ambiguous report on jobs in the US, upcoming presidential election, that will take place on November 6. Unfortunately it is hard to foretell the reaction of the market. However if we forget about fundamental reasons and look at the technical outlook of the market, then everything is clear.

The dollar continued the descending trend. EURUSD pair stopped at a support level of 1.2830. This is the third similar instance at this level, and if the price can break it, then the consolidation that has been active for 2 months will stop, and one may sell EURUSD for a long time.

Pound sterling looks stronger and the price lowered only inside the consolidation, there is a long path to the renewal of the minimum.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3149

The trading week happened to be confused, currency pairs moved in different directions during the trading week because of expectations of the news from regulators (the ECB president Dragi’s speech and FRS meeting). However FRS meeting didn’t bring any news. “Twist” program and extremely low rates will continue in the US. As it usually happens, the market moved a little bit before the news but the changes were minimal.

The whole background of trades can be determined as follows: lowering of risks, which is connected with lack of positive changes in Eurozone and there was a growth of dollar during the week. Thus EURUSD pair lowered the whole week and stopped at 1.2935, which is a little lower than sloping support, formed by two previous local minimums. EURUSD entered the 300-wide diapason.

That is why it is logical that at the beginning of this week one may expect signals to buy. A rebound may be expected from sloping support at approximately 1.2950, and formation of rebound model on Monday, since there is already a doji-candlestick on Friday. The aim of sales can be the upper bound of the diapason- which is 1.3130.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2924

Last week there was a deployment towards dollar of all currency pairs, which stopped the decrease in value.

This week it will be wise to trade “for dollar”, since it grows on all positions. For example EURUSD. The pair could not break down and renew local maximum on Wednesday, as many traders wanted. At the place of a breakdown it went down and is trading now lower than the secondary support of 1.3044, which became resistance. The opening of short positions may be realized immediately after market opening and the appearance of signals to trade: the rebound from the level of resistance 1.3044 or the renewal of minimum of last candlestick. The risk should be eliminated to 1.3050-1.3070.

Pound sterling is close to local minimum, which may support the island currency, especially because the pair actively descended for recent two days (Thursday-Friday). So despite the weakness of pound sterling traders’ purchases may appear at this level, those traders hoping for deployment. It makes sales with market openings less attractive, especially because GBPUSD pair is developing in the channel now, to the lower bond, with a small cruising range. Thus if there are open short positions, they should be held with instantaneous fixation of profits, with hints to rebound or quotations deployment, but it’s better to wait with opening of new ones, since the risk is too high.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3115

First two trading days turned out to be differently directed on Forex market. If on Monday dollar grew in comparison to all pairs, then on Wednesday everything was different and the fall of dollar, especially to European currencies was significant.

Thus EURUSD pair grew by more than 100 peeps and achieved the last maximum- 1.3050. The impulse of movement was very strong and with the update of local maximum on Wednesday the growth of quotations of EURUSD pair has to continue, since the pair drew the deployment shape of “double bottom”, which does not exclude the consolidation.

GBPUSD pair is set against the resistance too which is at 1.6130. The situation similar to EURUSD; the growth will occur after breaking down this resistance. However recently pound sterling looks weak in comparison with euro and dollar, that is why it is useless to count on it, and the correlation with EURUSD movement requires excluding it from the portfolio.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 2751

Traditionally before opening new trading week we conduct a little analysis and prepare to possible surprises from the market.

So let’s start with the EURUSD pair. Last week we saw a beautiful deployment within classic candlestick analysis (from Wednseday to Thursday), and we have a question now: will the growth continue this week? Friday made it clear that bulls in second half of the day started to fix the profits which led to losing EURUSD positions. Thus there will be attempts to push the quotations down on Monday. But because there is no signal for sales, one shouldn’t sell. And for same reason one shouldn’t buy during first hours of trade. Thus Monday will be decisive for choosing tendencies for a week.

Pound sterling looks more confident but not too much. The situation is almost the same as with euro, so it is advisable to stay out of the market. Just yet.