- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3271

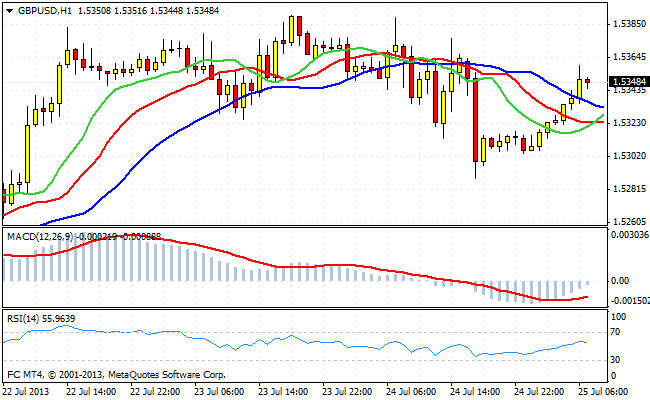

Trading in the FOREX market on Wednesday are expected to be active during the second half of the day. Is expected to yield important reports on inflation in the UK and the performance of the Bank of England's Mark Carney. This could determine the fate of a pair GBP/USD in the coming weeks. Market participants' attention will be focused on the pace of economic growth and inflation expectations. Constructive comments Carney can be the reason for the short and medium game to improve the pound.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3217

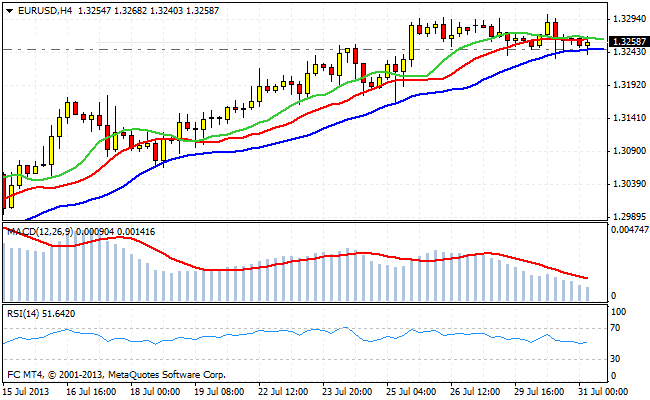

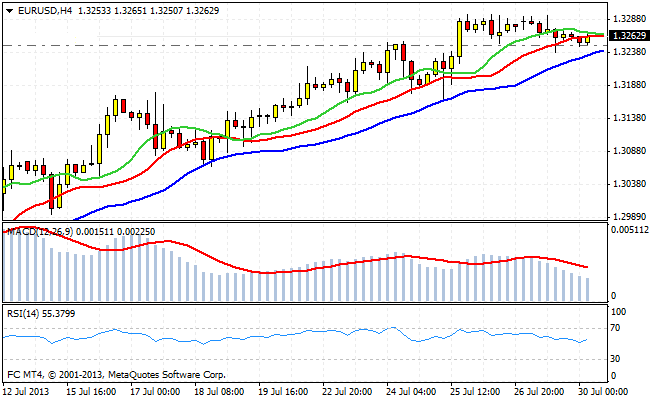

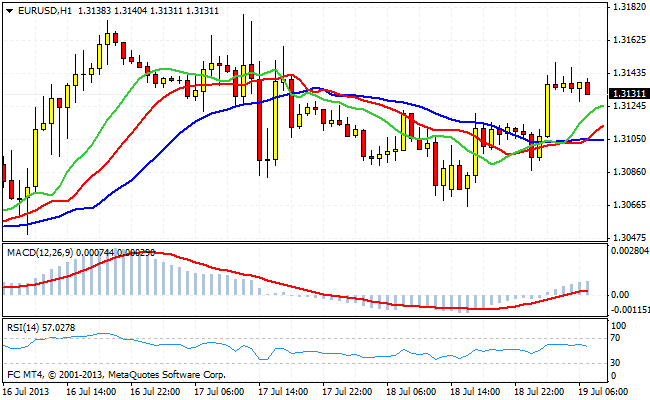

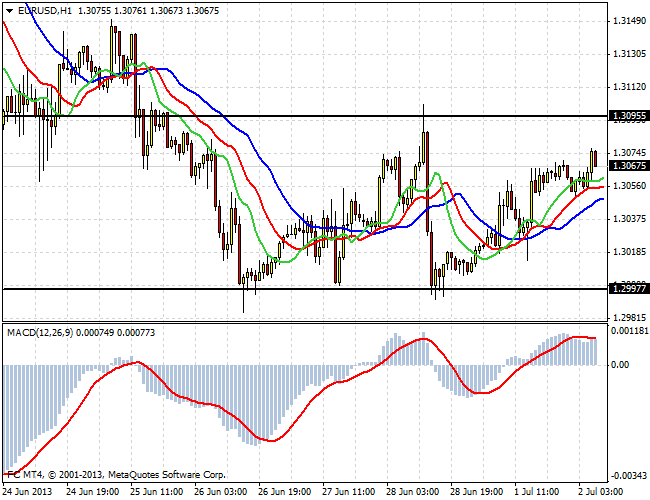

Beginning of the week did not bring with them any significant movements in the currency markets. Trading activity on the first day of the week was slightly above the average for this period. There has been some different trends among the major currency pairs. The fact that some couples who traditionally have a high degree of correlation, went in the opposite dealers attributed to the fact that the participants were guided by the local trend of the fundamental parameters. Good data on the business activity of the Eurozone could not keep the European currency at the highs on Friday. As a result, a pair quietly slipped into the close. News flow today will be mainly from the European region.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3188

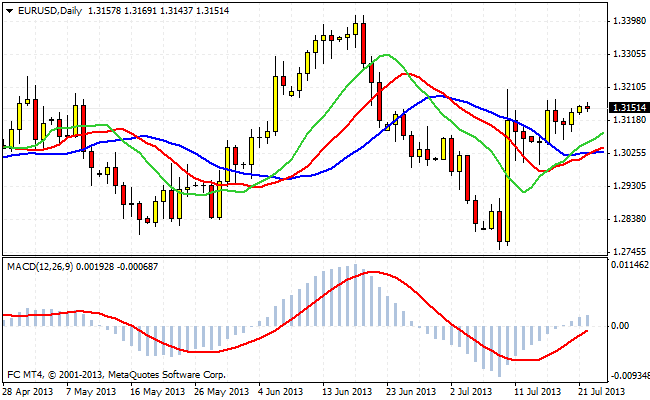

The last two weeks the markets get a large amount of information that could identify the medium-and long-term vector of currency movement. But as long as the participants do not rush to take aggressive positions. This limits the range on the major currency pairs. Despite the important data on the U.S. economy and the publication of results of the meeting of leading central banks, the situation in the foreign exchange market remained relatively calm. Apparently, at the moment dominated by technical factors.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 2795

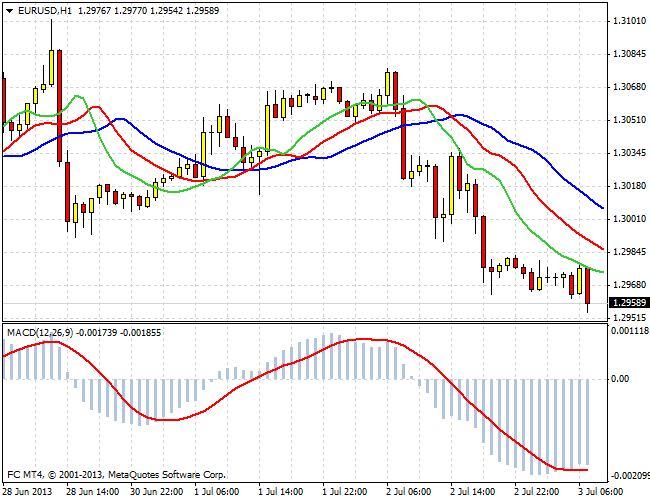

With so many traders are looking forward to applications from the central banks, which, apparently, partly burned. The result of publication of the results of the Fed meeting, the ECB and the Bank of England became the volatility at current levels. Ultimately quotes have not moved from their original values. In yesterday's trading session was quite a lot of news. Due to this dynamics of the major currency pairs was at a certain point in different directions. Despite the strong economic data from the Eurozone, investors chose to eventually sell the European currency. In the speech Draghi quotes pair EUR/USD started the downward momentum.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3352

Block macroeconomic news yesterday to make quotations of the main currency pairs fluctuate in different directions several times during the trading session. Well, at the end of the day began very real roller coaster. Strong and positive U.S. economic data the day contributed to the development of demand for the dollar, but before the FED's statement quotes again returned to previous levels. Data on employment and GDP of the United States have caused such a positive response on the dollar, as they could be an argument for the soon to minimize the program of quantitative easing. But Ben Bernanke's statement did not contain any hint of that in the near future may be a reduction in incentives.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3107

Tuesday on the FOREX market was relatively quiet. In the major pairs was some different direction. Quotes of the single European currency have attempted to test the 1.3 area, but the dynamics of the pair GBP/USD had a bearish trend. Drivers to start more or less strong move today will be enough.

Macroeconomic data will reveal different sides of the current situation in the Eurozone and the U.S. economy. In the European session, extend the data on the labor market in the Eurozone. Later, during the American session, participants will assess leading indicators of the labor market, to win back the GDP data for the second quarter (8:30), and at the end of the session to interpret the statements of representatives of the Federal Reserve (14:00).

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 2734

Judging by the importance of the upcoming news, trading this week promises to be quite active. Monday can be considered symbolic of the U.S. dollar during the day, as there have been some attempts to play on the rise of the U.S. currency. But, despite the desire of speculators to warm up before the markets publications outcome of the meeting of the central bank, quotes, currency pairs held by the current narrow ranges. News flow of the most powerful, the degree of potential impact on the markets, the data is expected in the second half of the week. Prior to that, most likely, further consolidation.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3083

Last week was quite an active market for FOREX. A number of macroeconomic news brought volatility to the market. U.S. dollar up again lost ground against major competitors. The dollar index reached 81.50 in the downward momentum that began in early July, after Ben Bernanke slightly dampened investors. This week will be rich in important data that could lead to a radical change of emphasis in the market. On the courses of further monetary policy and tell the FED, the ECB and the Bank of England. Apparently, these two days (Wednesday and Thursday) will be decided mid-term fate of the major currency pairs.

It should be noted that the focus will not remain without such data for the United States economy, as GDP for the second quarter and labor market statistics. All this will greatly affect the course of monetary policy. While the situation is such that the FED would prefer to delay the start of reducing redemption of bonds.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3647

Trading on the foreign exchange markets Thursday was very dynamic. Tension of the last days has resulted in attempts to pound and the European single currency to test the strength of local support. Driver of these movements served as a data packet on business news for the euro area and the UK's GDP in the second quarter. In the European session, the indices were published research institute IFO. The ratios presented in this time were worse than expected, it is somewhat disappointing investors. After a short period of volatility in the local maxima of the euro and the pound headed down.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3476

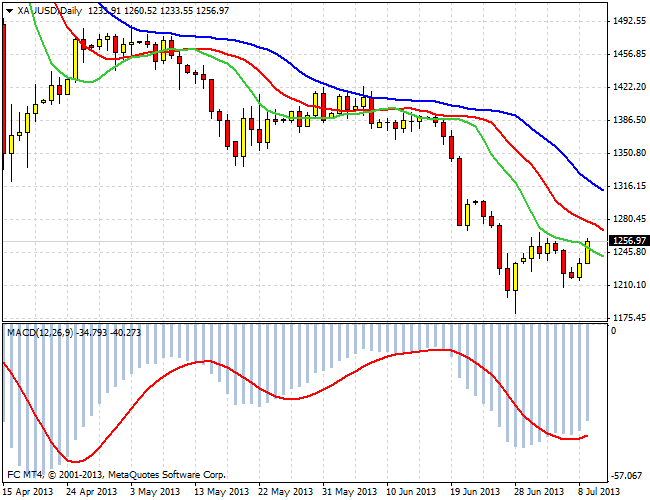

Bidding on the major currency pairs on Wednesday were in the ranges. Some increase in volatility was seen in the U.S. trading session, but overall significant changes in quotes did not happen. Bearish sentiment slowly return to commodity markets. Investors believe that the Fed's tightening policy will contribute to re-evaluation of risks and buying the U.S. dollar. In addition, investors are worried that China's economic slowdown will increase the negative attitude to the prospects of commodity assets.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3390

Beginning of the week in the currency markets is calm. In the absence of important macroeconomic data exchange drift up and down. In recent days there has been a strengthening of the single European currency and the pound against the dollar. Experts believe that this situation will change in the near future, as the fundamentals are now in favor of the dollar. Representatives of the European Central Bank said that the bank may continue to cut interest rates, given the current economic situation. The markets believe that the European regulator did not follow the example of the FED for a very long time. But ,nevertheless, the euro grows slowly due to technical reasons. Investors simply adjust long dollar positions due to a change in the rhetoric of Ben Bernanke for QE3 from aggressive to neutral.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3305

U.S. dollar slightly losing ground against its major competitors in the absence of significant macroeconomic data. The company regularly conducts Bloomberg survey of economists to determine the expectations regarding monetary policy the FED. Recent survey data indicate that experts are more likely to believe in the FED's willingness to act in September. So say about 50 % of the respondents surveyed Bloomberg. Their point of view, some experts based on the fact that the markets, in their opinion, has the potential to adapt to changes in the policy of the FED, and now tightening does not carry the risk of high volatility. In a sense, the representatives of the monetary authorities would be prepared as markets for end of stroke easing. The second half of the respondents believe that the FED will act only in the second quarter of next year.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3468

Last days in the FOREX market are characterized by low trading activity and moderate volatility. Apparently, quotes, currency pairs felt for some equilibrium zone, the output of which will be very dynamic. Fundamental factors that move the markets at the moment, most likely, will be the news of the central banks of the U.S., Eurozone and Japan. Rates of monetary policy the world's largest banks - is by far the main story for all financial markets. Renowned expert on debt markets, Bill Gross thinks that the FED is still quite a long time will not start tightening monetary policy. Finance believes that any decisive action the U.S. central bank may begin only in 2016. In the meantime, according to the expert, the FED will be limited to verbal tools and levers.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3147

The second day of speeches from Fed Chairman before Congress did not bring volatility in the currency markets. Ben Bernanke went on to do quite restrained statements, citing economic trends. The position of the Fed is extremely clear. In a sense, all the responsibility for further action Reserve shifts the dynamics of macroeconomic data. Market participants continue to monitor the incoming information. The rating agency Moody's yesterday revised its outlook on the U.S. rating to stable from negative. The main reason for this upgrade was provided by data on the situation in the economy of the state, which indicates a steady growth.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3536

The attention of investors at auction on Wednesday was focused on the speech of the FED to Congress. In recent days, the participants of the market was not easy to decide on the further prospects of the major currency pairs. The reason for this was some ambiguity in the statements of Ben Bernanke. A month earlier, the head of the FED, it would seem, has made it clear that the folding of the quantitative easing program will begin in the near future, almost in September. This caused a massive dollar purchases and avoiding risky assets around the world. But now the rhetoric of Ben Bernanke has become much softer. Abstracts of yesterday's report were also quite flexible.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3076

Today and tomorrow in the evening Ben Bernanke will speak to Congress. According to experts, the chairman of the FED once again remind the members of Congress and the markets that in the beginning of the collapse of stimulus measures will not follow the growth of the interest rate. Such updates often are taking place in recent years, as markets tend to overestimate the FED's intentions with regard to monetary policy. Rather, Ben Bernanke will continue to keep making controversial statements. The main guidelines in the Federal Reserve's monetary policy remains - economic growth and labor market situation.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3732

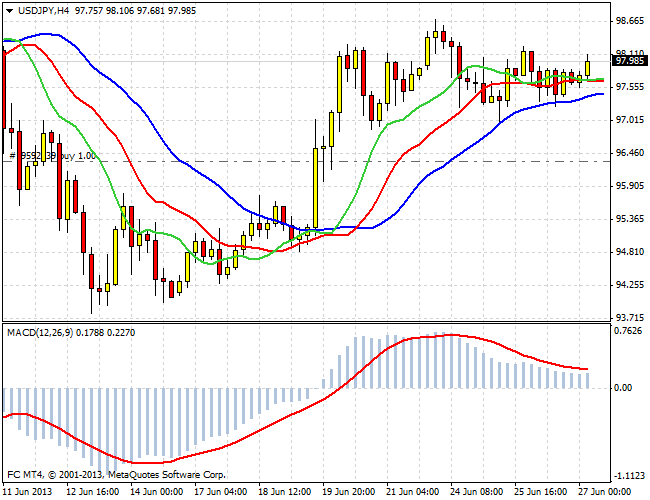

The trading session at FOREX market on Tuesday - July 16, runs quietly enough. Partly activity is noted in the USD/JPY pair before the European trading session. In general, the situation is neutral. Apparently the players have decided not to take decisive action before the publication of the FED's Beige Book on Wednesday. Yesterday's weak economic data on retail sales in the United States has not allowed the dollar to resume growth. Thus, the market is now felt certain equilibrium level, get the ball where he can help only significant news.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3868

Trading in the FOREX market on Monday held in moderation. The past week has been rather volatile, and the reason for this was neutral comments from FED Chairman Ben Bernanke and a number of macro-economic data from China. The situation in the Chinese economy worries many market participants. Representative of the Middle Kingdom financial authorities forecast a further slowdown in economic growth, and this will adversely affect the commodity currencies, and on the desire of investors to invest in risky assets. FED policy takes into account the situation in their forecasts in China, so market participants will closely monitor the actions of the Federal Reserve and the rhetoric of its president.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3318

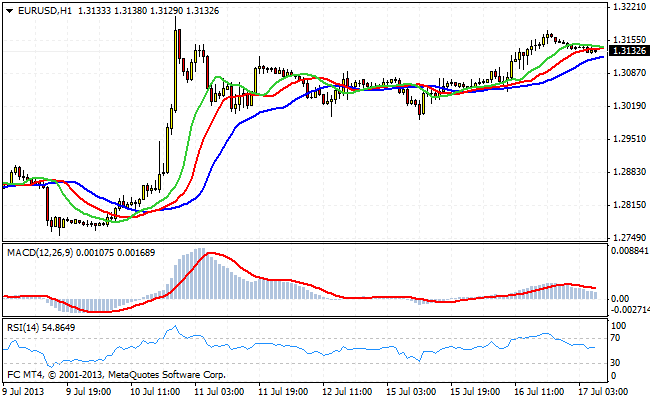

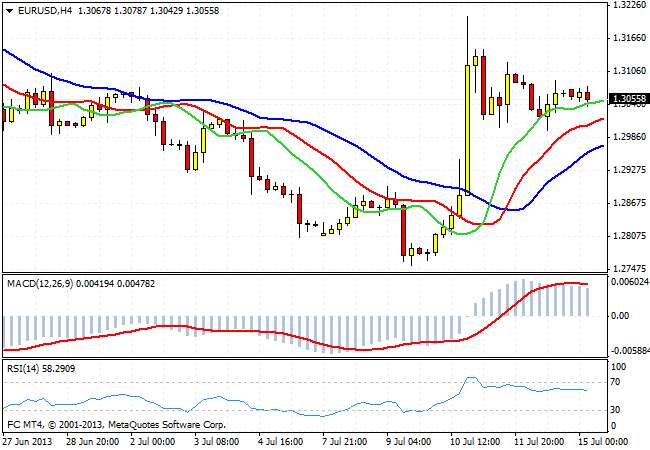

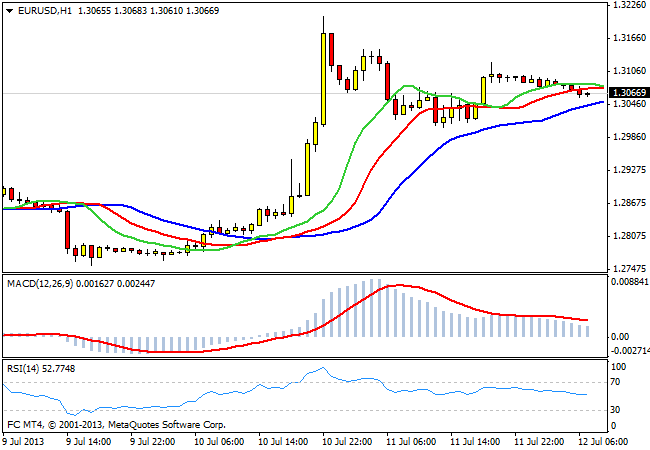

In recent weeks, the dollar has made a very serious bid for the long-term growth. In this regard, his abrupt departure this week is the subject of much debate among traders and analysts. Skeptics on the dollar in one voice insists that the markets since the beginning overestimated the FED's willingness to take decisive action, and that such a total purchase of U.S. currency was no reason. So as soon as Ben Bernanke's rhetoric changed to neutral, market participants revised their forecasts and have had to close a lot of long dollar positions. If the quote currency pairs will not change much until the end of Friday's trading session, the first time in a month dollar closes the week lower against its major rivals.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3396

At yesterday's auction at the end of the U.S. trading session, the chairman of the Federal Reserve signaled to the market that the possible start reducing stimulus measures - this is not the tightening of monetary policy. Thus hinted that the time of cheap money has not yet passed. According to some experts, Bernanke is trying to show that the decline in QE3 will not result in a reduction in the balance. And, do not jump the gun, as long as the labor market is still quite weak, and inflation rates are low, and that's all, in turn, suggests that reducing the volume of bond purchases at this time early. Thus, Ben Bernanke said that as long as until the cogent arguments supporting a significant improvement in the economic situation, the FED intends to continue to pursue accommodative monetary policy.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3615

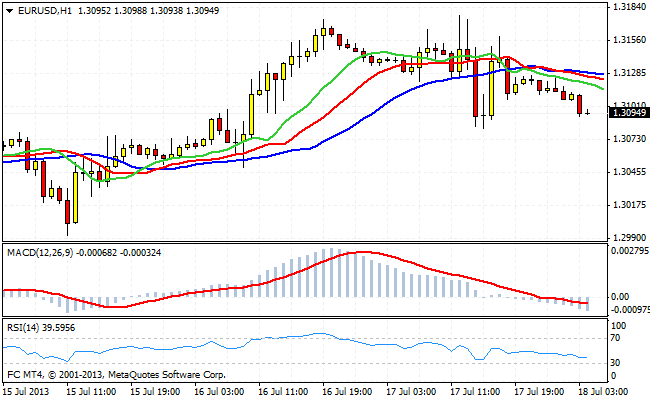

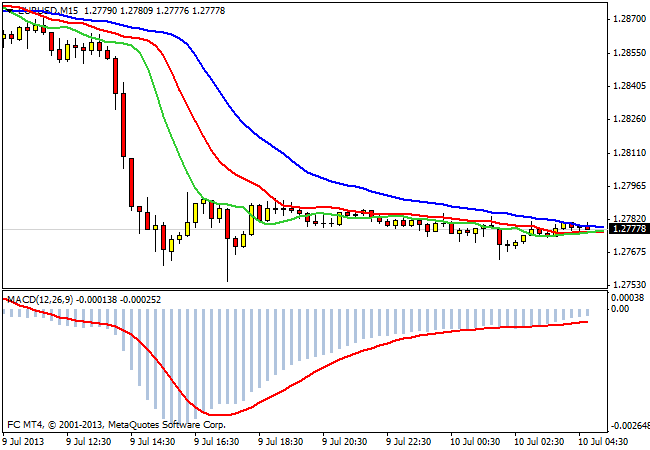

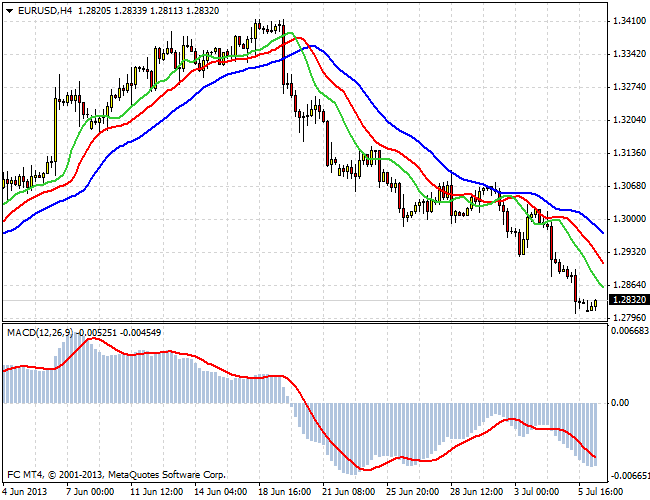

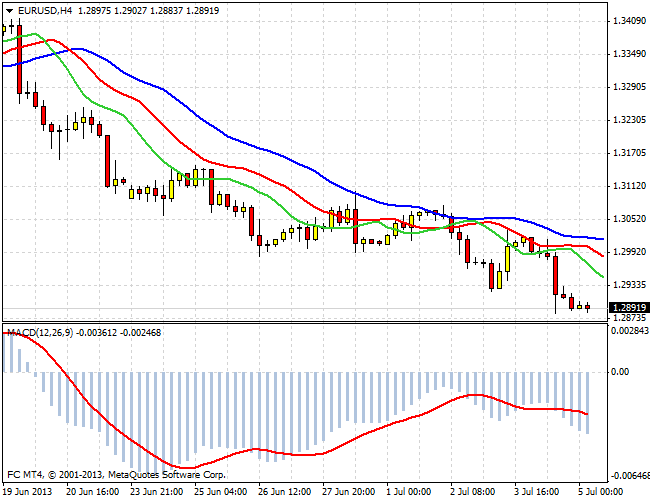

On tuesday, trading in the foreign exchange market were some imbalances. Investors do not hurry with the occupation of large positions, but, nevertheless, in some currency pairs observed increased volatility. Since EUR/USD pair showed decline in the second half of the trading session, reaching a three-month low of 1.2750 . The reason for this was the reduction of the credit rating of Italy. Specialized rating agency S&P cut the rating by one notch to BBB with BBB+, confirming a negative outlook. Thus, the agency's analysts believe that the situation in the economy and the financial sector will only get worse.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3582

Despite the fact that the market has a lot of skeptics in regard to the future prospects of the dollar, the experts of a number of large investment banks are convinced that the dollar is currently on the verge of a powerful wave of growth. So UBS believe that an increasing number of members of the Federal Reserve will maintain the initiative on QE3 minimize the program and the transition to tighter monetary policy. Due to the fact that the current week is not very rich in news, the main topic of discussion is the situation in the U.S. labor market. Tomorrow, the publication of the minutes of the Fed meeting, resulting in the dollar could get support.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3398

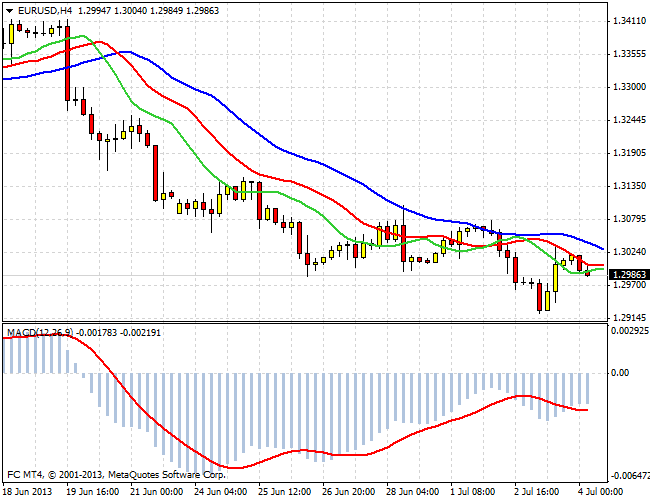

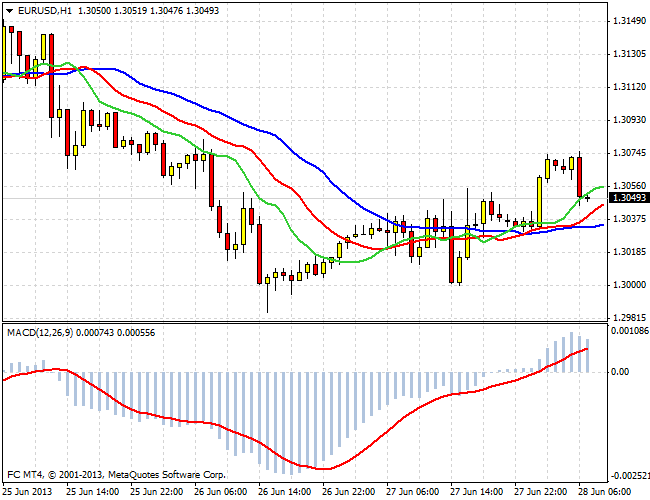

The previous trading week for currency markets was somewhat critical. Central banks have decided on the course of monetary policy. The Fed has made it clear that it intends to begin curtailing stimulus measures already in September, if the labor market will continue to show strength. The ECB and the Bank of England, by contrast, have expressed readiness for further easing. EUR/USD was under pressure all week and showed a decline in area of 1.28 .

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3331

ECB meeting held no surprises, the interest rate has remained at the same level. Draghi said the bank's monetary policy will remain soft. The head of the European Central Bank does not rule out any further easing. In addition, in the comments, it was noted that the ECB is ready to launch OMT program at any time. But while it's still only at the level of conversation. Experts believe that the special effect of lowering the deposit rate below zero can be expected.

EUR/USD to the publication of the results of the ECB reacted to decrease by about one piece. Market participants decided that the euro has virtually no prospects for medium-term period of time. The pair quickly fingered the level of 1.2880, and is trading near it. Current downtrend develops. Short positions should definitely hold, because at the bottom there is a lot of goals. These levels are 1.27 and 1.26.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3437

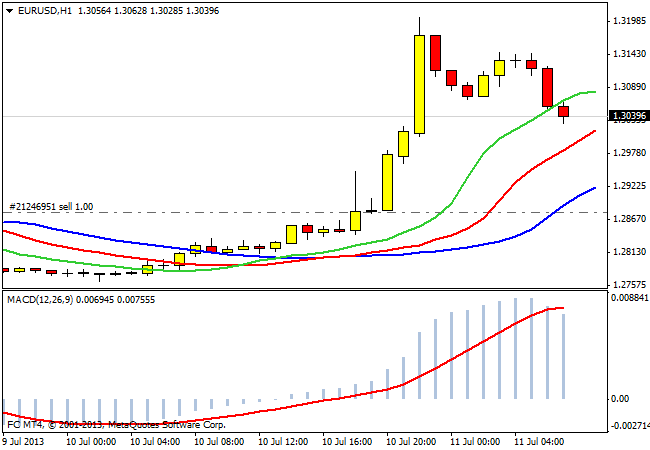

Despite remaining at the moment the upward trend for the dollar, the chances of a significant correction movement across the front are quite large. As part of the bullish trend dollar reached a number of important levels against the major currencies, and now some market participants are preparing to play in the opposite direction. Arguments for the classes of aggressive speculative positions today may be enough. This data on changes in the volume of euro area GDP (13-00) solutions at the rate of the Bank of England and European Central Bank (15-00 and 15-45). In the United States today are celebrating Independence Day, so the stock exchange and banks are closed.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3038

Since the beginning of the trading session, an increased demand for the dollar. Most likely, the correction phase is over and we will see further strengthening of the dollar against major competitors. The fundamental factors that contribute to this scenario, remain the same investor expectations regarding future monetary policy of the FED. Some experts predict a further sales of risky assets around the world, and care dollar. Markets are closely watching the macroeconomic data, as they determine the rate at which the FED will cut the program QE3.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3370

Immediately after the opening of the Asian trading session, the major currency pairs were calm. Except, perhaps, were quotes USD/JPY. Euro opened neutral and gradually grows in European trading. The pair is attempting to test the upper limit of week channel at 1.3090 . District 1.3 proved to be quite a serious level of support for the stock of the single European currency. This may be due to the fact that, as a rule, round values are optional and psychological barriers. At the same time, such a long stop can result in a major boost when the support will still be passed.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3250

Reactions of the markets to verbal signals from strong financial this world - an everyday occurrence. When Ben Bernanke has started talking also potential turning of the program of quantitative mitigation, high volatility has come to the markets. Everything was in a fever, beginning from debts and finishing commodity derivatives. For example, capitalisation of the world markets of actions has decreased more, than by 2 trillion dollars. In the currency markets recently the dollar continues the offensive actions. A number of experts believe that head of FED tries to prepare the markets for hard times.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3707

Despite a flow of important news, trades on Forex this week were low-key. Investors were slightly disappointed by final data on gdp from the USA, nevertheless demand for dollar is still quite high, and this tendency will most likely stay during the next week. They say that generals do not run. This means that if large-scale players decided to play for dollar growth it will last long. And aim levels in this game on the main currency pairs, can be quite serious.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3864

Previous day passed without any significant movements on stock market. After publishing final numbers on gdp from the USA, that were revised from 2.4% to 1.8%, American market of stocks demonstrated the growth on the whole spectrum of indexes. In financial circles all the discussions were concentrated around the subject of QE. The markets are worried about the rumors about a possible exit from the game of the current FRS chairman Ben Bernarke.